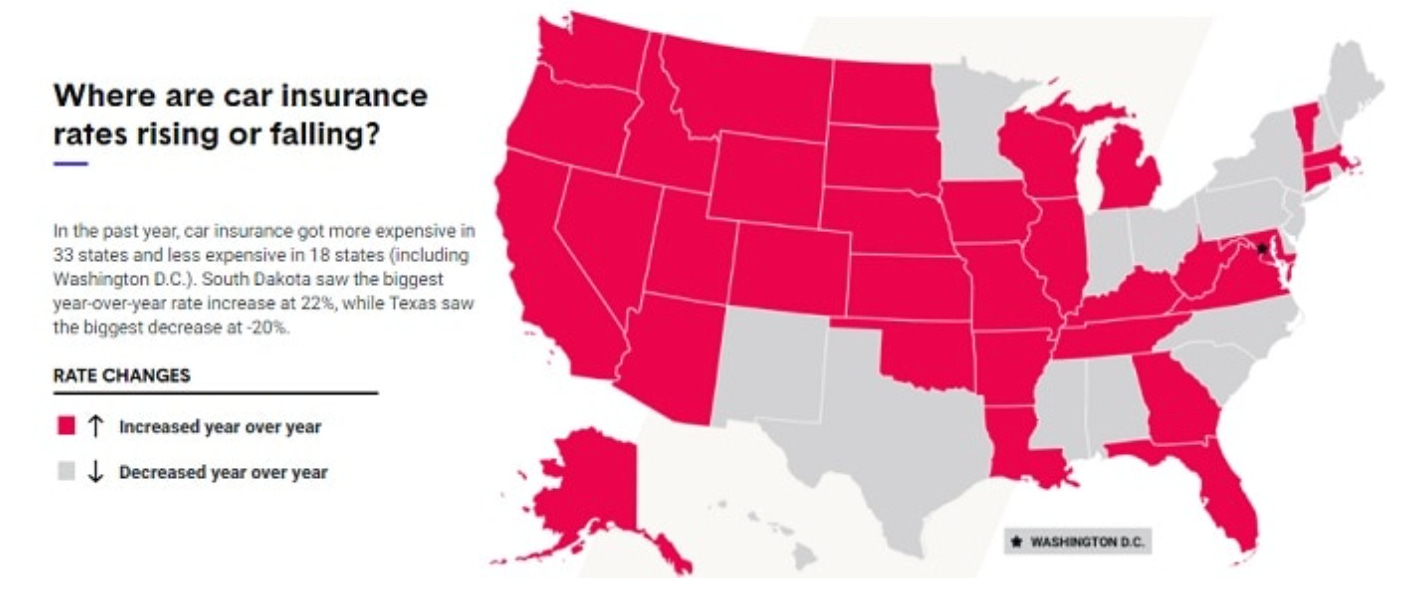

One would think auto insurance would be cheap in South Dakota. After all, South Dakota is a small rural state and state law requires automobile owners to be able to show proof of financial responsibility (normally handled with insurance) for any automobile they drive. In addition, companies that finance cars require people getting car loans to show proof of insurance. Also, there are penalties if someone does not have insurance and gets into an accident.

So why are car insurance rates increasing rapidly in South Dakota and why are the rates some of the highest in the country?

For the most part we can thank the people who claim to live in South Dakota, but really live elsewhere.

States with higher population bases have higher accident rates and as a result, more costly insurance. If you are a small mostly rural state, but have a lot of non-residents claiming residency in your state, there will be more accidents associated with your state. As a result, the insurance rates will go up.

So the reality is the lawyers and mailbox companies who are “selling residency” to people who don’t really live in the state, are raising insurance rates for those of us who really live here.

One solution would be to require insurance companies to force people to return to the state where they have insurance for all repairs that are not critical. If someone really lives in Minneapolis or San Francisco it would be financially impossible for him/her to return to South Dakota to get his/her car repaired every time he/she is in a fender bender, so he/she would have to change his/her residency.

Another option would be to force insurance companies to track incidents by locations. If there is more than one incident in the same out of state location, the policy would be under review. If there are two incidents, the company might need to take further investigative action.

The problem with both of these solutions is they would be administrative nightmares and require coordination between states (which is nearly impossible).

The fastest and easiest way to solve the problem would be to solve the residency issue (only allow people who really live in the state to have residency). There is a bill, HB 1066, going through the legislature now that would strengthen residency requirements. It left committee yesterday.

If you would like to see lower insurance rates, make sure you contact your legislators and request that they vote yes on HB1066.

.

Blake thank you for expressing your concerns. It is nice to hear from you. My understanding is when you are in the military you can pick any state you like for your residence. Once you retire you live where you reside. If your issue is income tax, there are several states that are low/no tax. One of the big issues right now is we have a lot of people who do not live in the state voting in our elections which as you might imagine makes it frustrating for the people who really live here. Also, the people who live in the state are a bit upset with the amount their auto insurance has escalated (part of which is accidents that happen in more expensive areas). And I am sure the community where you land will want a military veteran involved in the community (including voting).

The point is you don't live here...but you want to vote in our city, county. State elections and other than licensing your vehicles here you are not a citizen of South Dakota. If you want to live here...then really live here, but your $7000.00 doesn't mean you should be able to vote as if you are a South Dakotan. You need to vote where you actually live and sleep.